“We’re not changing anything radically,” he said.

The University’s efforts

In June 2009, there were 279 endowments underwater — meaning they had lost enough value to be worth less than their original amount. As of November 2010, the number dropped to 178. The target for next year is fewer than 30.

UNC Management Co. invests money for long-term growth — it doesn’t raise money to cover short-term gaps.

Meanwhile, the University’s development office is working to connect with donors to make up some of the losses.

“We’ve redoubled our efforts to see as many potential donors as we can,” said Scott Ragland, spokesman for the Office of University Development.

In the last three fiscal years, the development office averaged about 2,500 donor contacts that could lead to a gift. That’s 23 percent more than the average for the three years before, Ragland said.

Most of that money goes to UNC Management Co., with the hope that it grows faster than inflation.

The rules

UNC Management Co. tries to make at least 8 percent annually, so it is able to pay out about 5 percent to the University while maintaining the value of the fund after inflation.

Each year the company’s board sets a distribution rate dictating how much of the endowment funds the University can spend.

It’s tricky business.

To get the day's news and headlines in your inbox each morning, sign up for our email newsletters.

“It’s a balancing act between the needs of the present and the needs of the future,” said Bill Jarvis, managing director and head of research at the Commonfund Institute.

Just more than three years ago, the board had been preparing for a rainy day by setting the distribution rate below 5 percent, King said.

But endowment funds got criticism nationally and from members of Congress for growing larger and not spending enough on the institutions they were meant to support.

So the board decided to hike the rate to 5.7 percent.

“The rainy day turned into a typhoon,” King said, referring to the market collapse that followed. “The timing was absolutely perfectly bad.”

In the fiscal year ending 2010, endowment support for the University dropped $1.9 million — its first decrease in dollar terms ever.

But even as UNC faces budget cuts from the state of 5 to 15 percent, increased payout from the endowment might not help, King said.

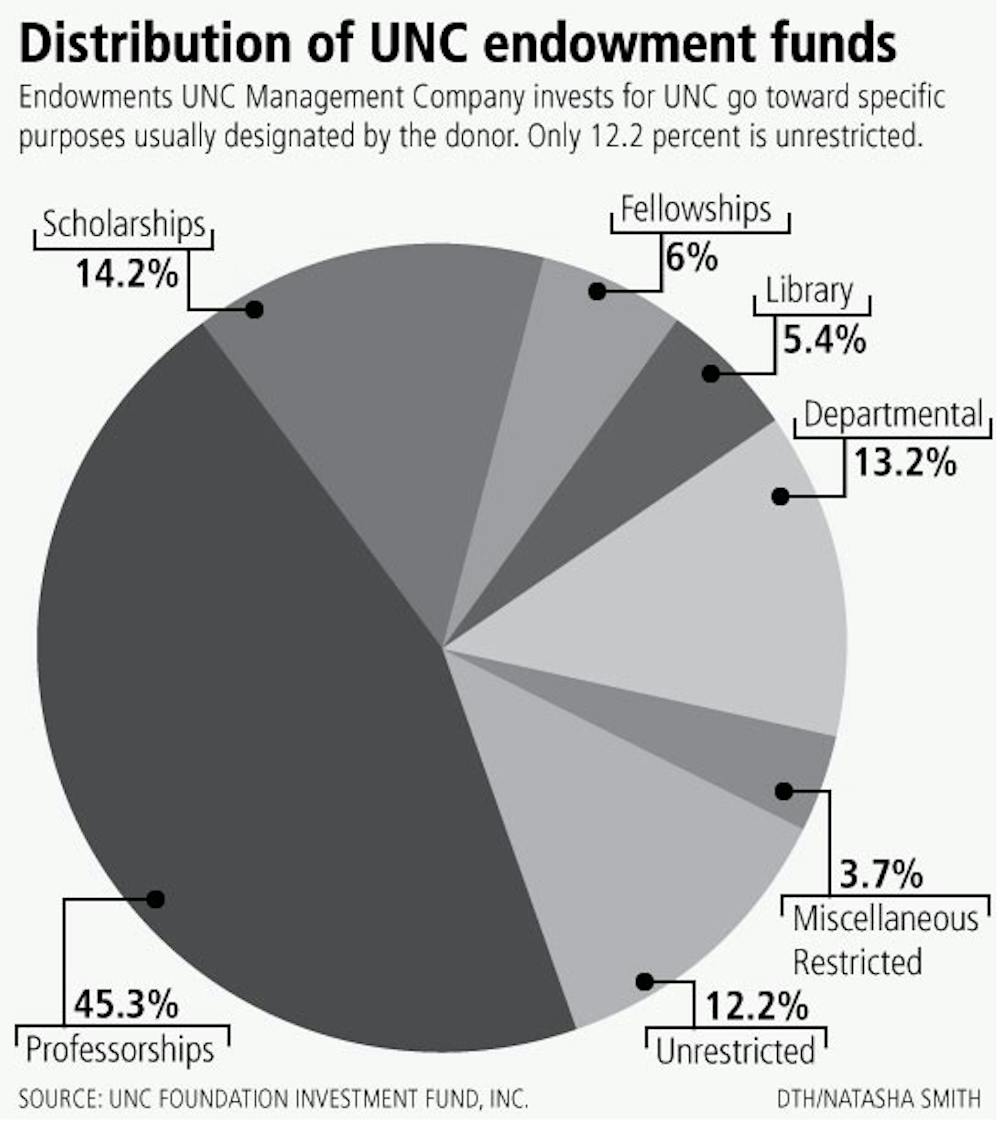

The fund is made of thousands of endowments that support specific professorships or programs.

“What we do, in that sense, is independent of what’s going on in Raleigh,” he said. “These endowment funds are for specific purposes — it’s not like you can use endowment funds to plug budget gaps other places.”

The long-term view can drive people crazy, he said.

“They all want to know what we’re doing right now,” King said. “The markets can act very irrational so you just have to be patient and stick with it.”

Contact the University Editor at university@dailytarheel.com.