Following a discussion today on how best to fill short-term funding gaps with tuition hikes, members of the Board of Trustees will focus their attention on the long-term financial health of the University.

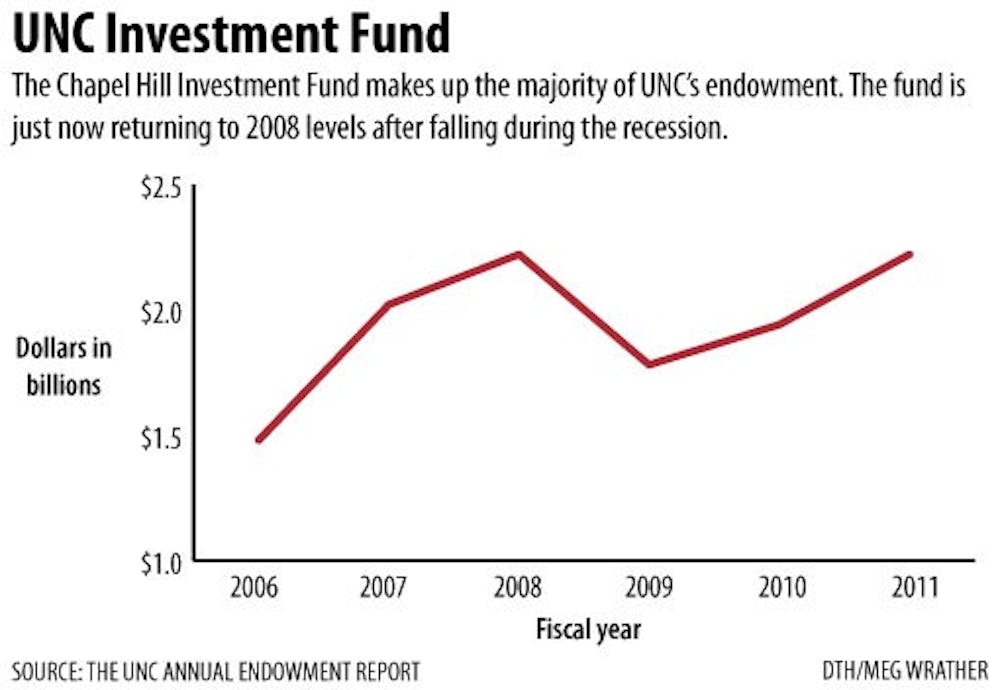

Between 2008 and 2009, the Chapel Hill Investment Fund’s value decreased 19.8 percent, from $2.22 billion to $1.78 billion. This fund makes up most of the University’s endowment.

In the last two fiscal years, the fund bounced back, and once again is $2.22 billion.

Jon King, president and CEO of the UNC Management Co., which manages the fund, will give his annual report to the budget, finance and audit committee of the board today about the University’s endowment.

The endowment is made up of privately donated funds. Most donations are restricted to specific uses.

The donated money is then invested, and the interest from the investment funds the endowment’s goals.

The endowment focuses on the long-term growth of UNC, especially through funding scholarships and faculty positions.

King said the percentage of the total endowment made available each year for use by the school changes depending on economic circumstances.

That percent bottomed out at 4.4 percent in 2008, and increased to 5.6 percent for the last fiscal year.