Preparing tax returns can be difficult for anyone, and that process can be even more daunting for non-English speakers.

But with tax season in full swing, Hispanic families in the Carrboro and Chapel Hill area will have options this year when it comes to tax preparation.

Carrboro has the highest Latino population in Orange County with 13.8 percent — 5.6 percentage points higher than Orange County as a whole, according to 2010 U.S. Census Bureau data.

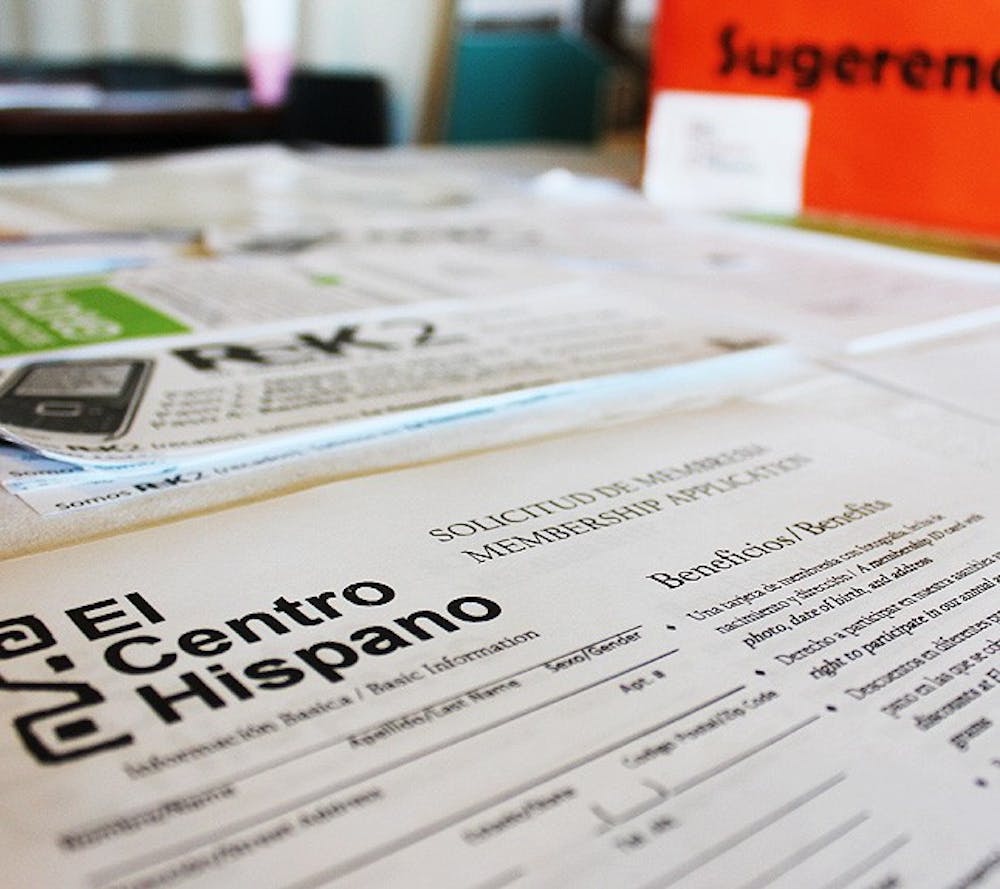

“Our mission is to integrate the Latino community so that both the new immigrants and those who are already here can have better (lives)” said Pilar Rocha-Goldberg, President and CEO of El Centro Hispano.

She said the program can help with the language barrier and lack of knowledge about tax filing.

“Without the program, participants would have more difficulty doing taxes on their own,” she said. “They might turn in the wrong paperwork or even not do them.”

Another option available to residents is the IRS Volunteer Income Tax Assistance program, which is offered for free to people who earn less than $50,000 a year.

About 48 percent of Orange County residents could qualify for the federally run program, which uses volunteers to fill out tax returns and educate low to moderate-income families about the earned income tax credit.

With more than 2,000 federal tax returns last season, Jill Hallenbeck, the VITA site coordinator for Orange and Chatham counties, stressed the importance of the program.