Members of the N.C. General Assembly are proposing to revive a controversial lending practice that has virtually lain dormant for more than a decade.

Advocates of the practice — known as payday lending — say the ability to obtain quick loans, with new consumer protections, would aid low-income residents during a slow economic recovery.

But opponents of the measure counter that the loans could trap residents in a cycle of debt — the same reason the practice was previously banned.

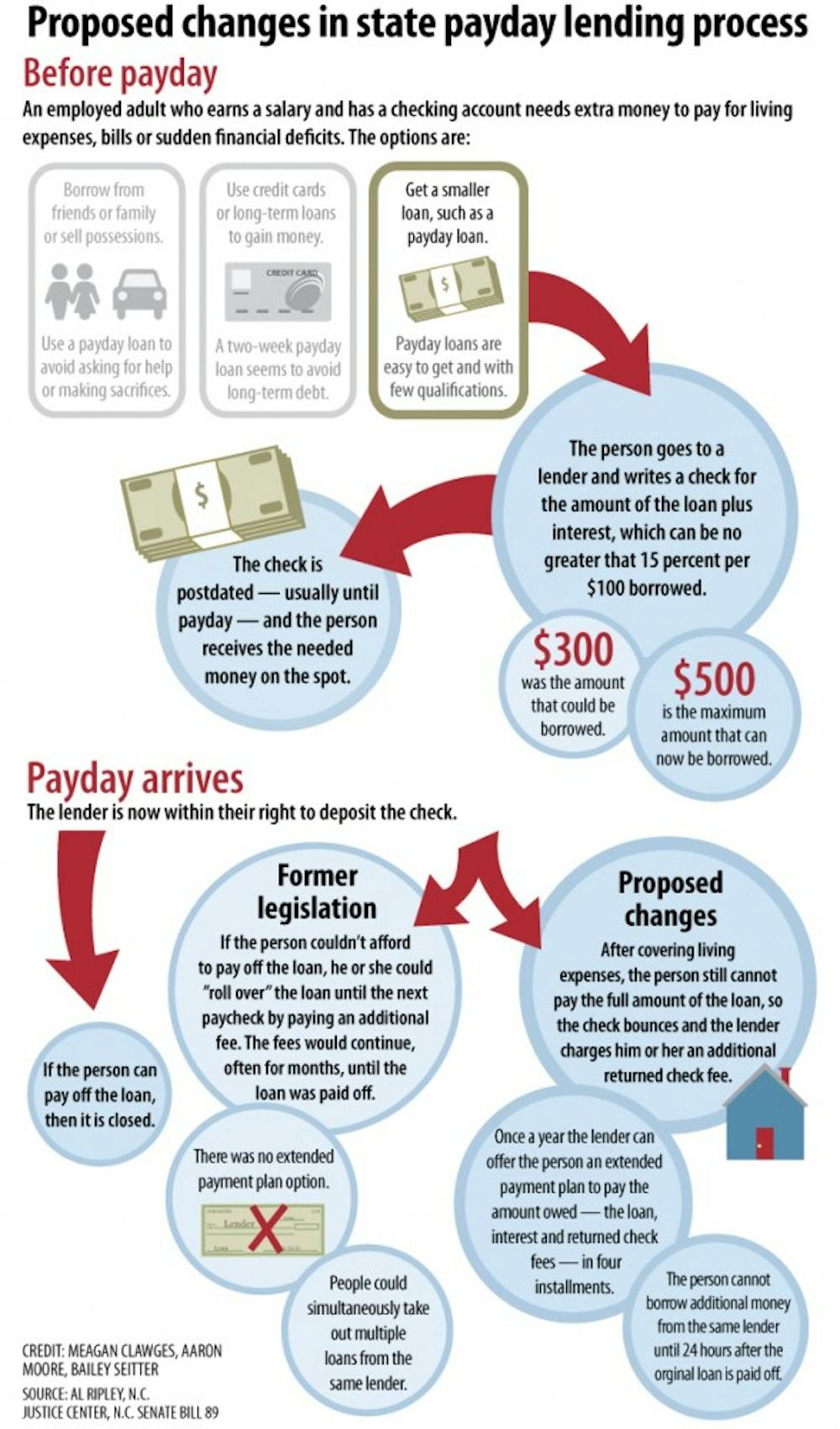

Payday lending allows people with a job and checking account to pay immediate expenses by taking out small, short-term loans before their next paycheck. The legislature banned it in 2001.

“The demand (for the loans) has never gone away in North Carolina,” said Jamie Fulmer, regional spokesman for Advance America, a national payday lending firm.

Sen. Jerry Tillman, R-Randolph, introduced Senate Bill 89 last week, which would enable residents to borrow up to $500 and cap the interest rate at 15 percent on every $100 borrowed.

North Carolina is one of 12 states that prohibits the practice.

Fulmer said the bill would provide a simple, transparent and cost-efficient credit option for N.C. residents.

“(People) get to a point in time where they have more month left than money,” he said. “They’ll be able to use this loan to bridge that gap.”