CORRECTION: Due to an editing error, The Daily Tar Heel misrepresented the headline of the story as "Proposed sales tax bill could unite urban, rural counties in NC" on Tuesday's front page. The headline should reflect that the proposed sales tax bill could divide rural and urban counties in NC. The headline has been updated to reflect this change. The Daily Tar Heel apologizes for the error.

The N.C. House of Representatives voted overwhelmingly against the economic development bill — commonly known as the N.C. Competes Act — during a concurrence meeting Aug. 19, but the debate is far from over.

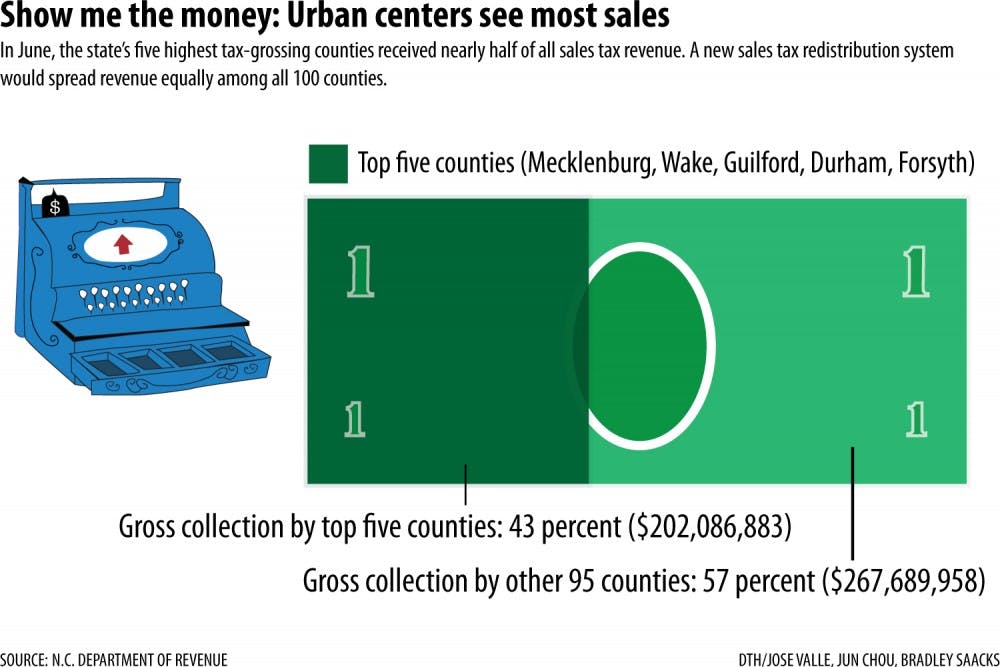

While the N.C. House drafted the bill to include Gov. Pat McCrory’s economic initiatives, the N.C. Senate added a controversial provision to shift sales tax revenues to lagging, largely rural counties.

“I think this is one of the most important bills we will see this session,” Senate Majority Leader Harry Brown, R-Onslow, said at a March press conference when he unveiled the tax redistribution plan.

The current scheme has segmented the state, providing huge advantages to booming urban areas while neglecting other counties, Brown said.

Wake County receives $145 million from sales tax revenue annually, compared with nearby Warren County’s $2.4 million, Brown said. Likewise, Mecklenburg County receives $193 million, while neighboring Anson County receives $2.8 million, he said.

“In fact, the current system has allowed Mecklenburg County to receive more sales tax revenue than (more than) 50 of our least prosperous counties combined,” Brown said. “That’s just not right.”

The current debate about sales tax redistribution can be traced to 2007, when rural counties sought relief from Medicaid expenses. To relieve this burden, North Carolina assumed financial responsibility for Medicaid in exchange for a half-percent of sales tax revenues. The legislature also divided another two percent among the counties based primarily on location of sale and, to a lesser extent, population size.