As Congress works to overhaul the United States tax system, one local leader hopes to use North Carolina as an example.

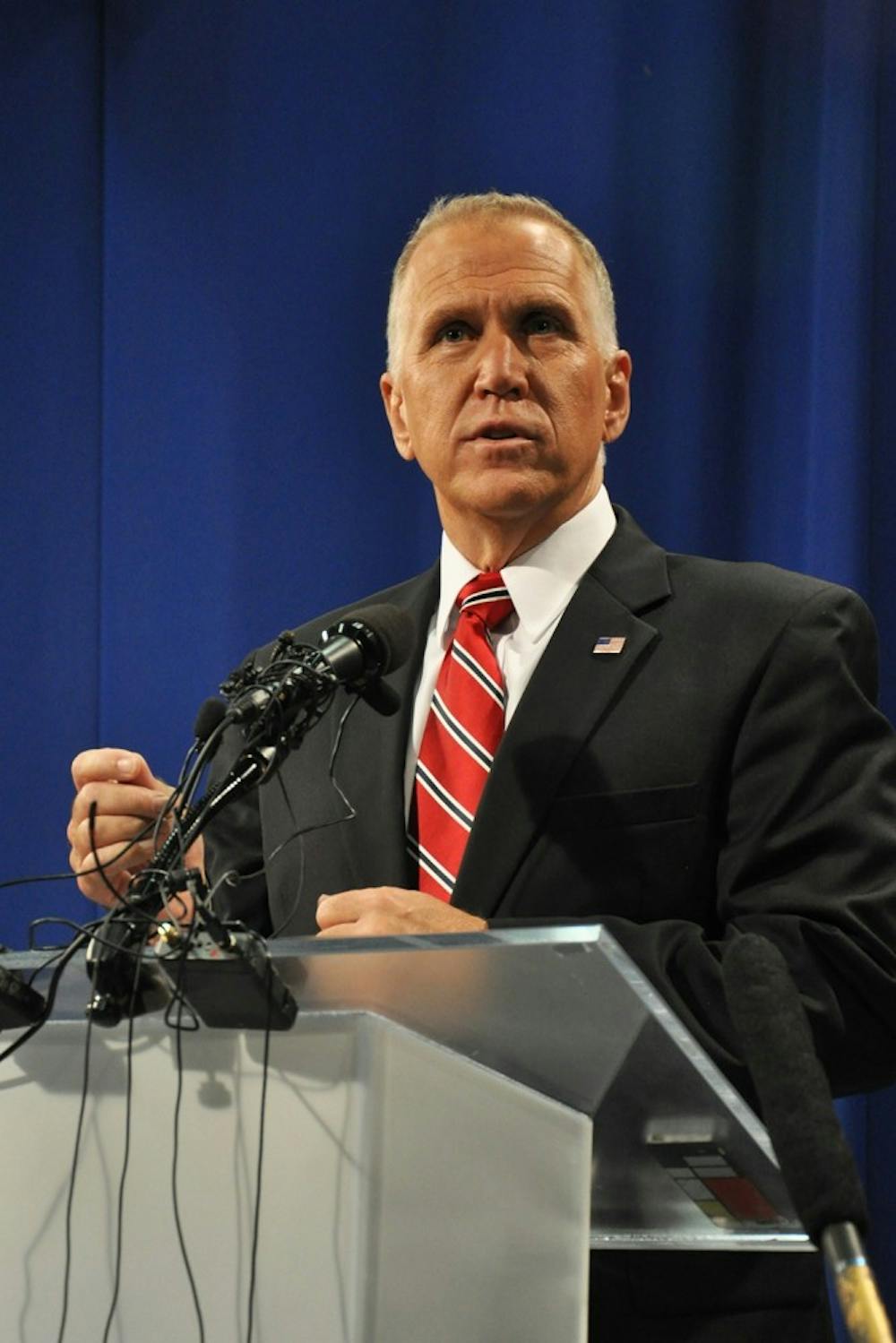

Sen. Thom Tillis, R-N.C., penned an op-ed in the Wall Street Journal last week about the success of North Carolina's 2013 tax reform under his leadership.

“In 2013, when I was speaker of the (General Assembly House of Representatives), North Carolina passed a serious tax-reform package," he said. "It was based on three simple principles: simplify the tax code, lower rates and broaden the base."

Kathleen Thomas, a professor at the UNC School of Law, said North Carolina used to have a progressive income tax, meaning that a higher income led to a higher tax rate.

"What lawmakers did a few years ago was changed the rate system, so we now have a flat rate, and it’s a lower flat rate than everybody faced before,” she said. “It used to be a progressive rate that got higher and higher — now everybody pays 5.5 percent, and that was a tax cut for everybody.”

Tillis said in his op-ed that the political alignment in the state's government in 2013 was similar to the current political alignment of the national government.

“Republicans controlled the governor’s mansion and both houses of the General Assembly, but there were disagreements within the GOP on how to implement tax reform,” he said. “We made compromises and achieved consensus.”

Tillis said the effect of the tax reform was a large period of economic growth for the state.

“The state’s economy has jumped from one of the slowest growing in the country to one of the fastest growing,” he said.