At $1.4 trillion, student loans are the second-largest source of household debt in the United States. A recent study, however, found students are starting to borrow at lower rates, which cast doubt over the student debt crisis narrative.

But it may not be that simple.

The National Center for Education Statistics released its National Postsecondary Student Aid Study in January. The report compiles information from randomly selected schools and is intended to measure how students and families pay for their education, said Tracy Hunt-White, the project officer.

One of the most notable findings of the study was that 72 percent of undergraduates received aid, an increase from 2012, she said. The number of those receiving grants rose, and those taking out loans decreased.

While these numbers may seem promising to anyone worried about a student debt crisis, Joydeep Roy, a visiting professor at Columbia University, said the issue is one that has to be looked at from several angles.

He said even though the number of students taking out loans has been on the rise, the number of people going to college has also increased. About 30 percent of new student debt can be attributed to an increase in enrollment since 1989.

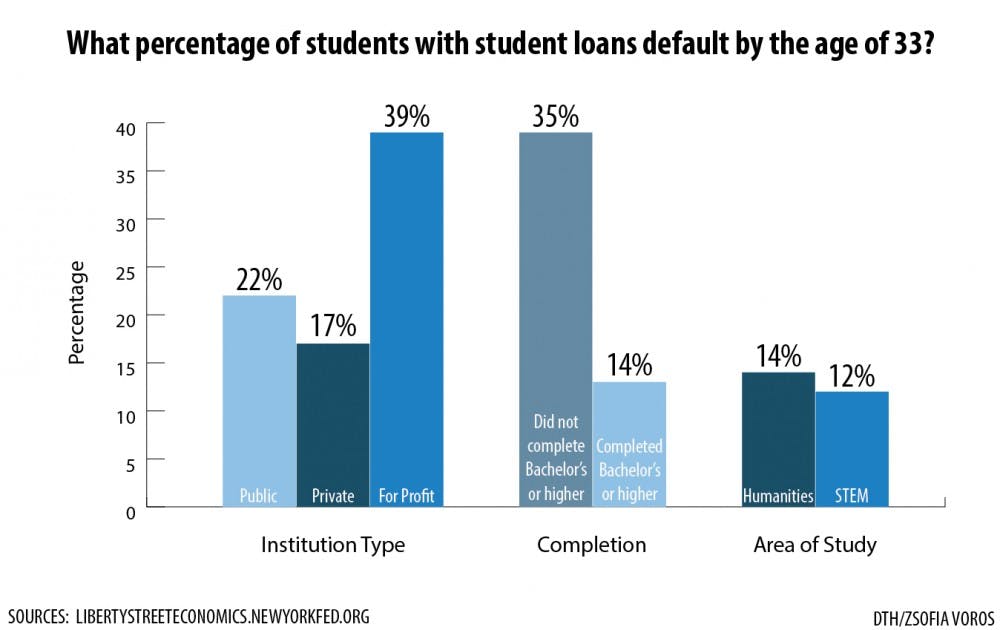

The percentage of students who default on their loans, rather than the percentage of students who take them out in the first place, could be a better indication of whether or not a student debt crisis exists, he said.

There are several factors that affect default rates.

The reauthorization of the Higher Education Act in 1992 made it easier to get federal loans, and a large amount of money can be borrowed without realizing the consequences.