The U.S. is lending more money in federal student loans than what is being repaid, according to a January report from the U.S. Department of Education — and the Department is not doing much to respond.

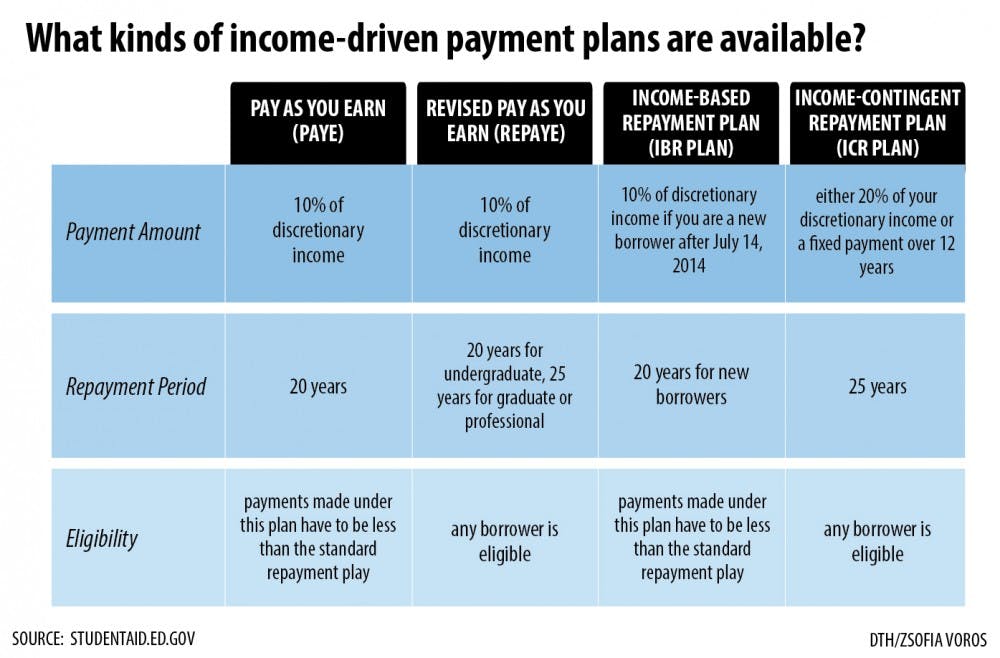

The Department's Office of Inspector General audited several federal student loan programs, such as Pay as You Earn and Public Service Loan Forgiveness, to see if their costs were effectively communicated to lawmakers and the public. The report determined communication regarding these programs and their costs could have been more informative and easier to understand, particularly when it related to future management.

Participation in income-driven repayment and loan forgiveness programs have grown in recent years, and the government is expected to lend more money than borrowers repay. Subsidy costs for IDR programs increased 748 percent from 2011 to 2015.

Five million people used IDR programs in 2016 – an increase from the 700,000 that used them in 2011. The Department wanted to add 2 million more to the program in 2017 while also expanding the student loan forgiveness program. Neither the Federal Student Aid report nor the Department’s budget outlined the financial impact of this growth.

The Department has also come under scrutiny for its handling of complaints from students in the federal student loan program. The Consumer Finance Protection Bureau released a report in 2017 saying it handled over 44,000 complaints since July 2011.

The report said complaints from both federal and private student loan borrowers were mostly about widespread servicing failures and “sloppy, patchwork” practices at the Department. Many students also reported problems with and confusion about enrolling in IDR and loan forgiveness plans.

Secretary of Education Betsy DeVos has not commented on these complaints.

The Office of Inspector General recommended that future publications from the department include nontechnical language that can be easily understood in order to fully inform lawmakers and the public about the future cost of federal student loan programs.

Forty-five million Americans have student loan debt, and out of those who graduate from a university, 60 percent take out loans.