The disease causes severe liver dysfunction until eventual failure, along with serious residual effects. One of the symptoms of the disease is an accumulation of toxins like ammonia in the brain.

For Tedrow, that meant a loss of many essential brain functions, like the ability to open the car door and count change.

Prior to the diagnosis, he and Mary ran a jewelry store in Pawleys Island, S.C.

“When a tiny, 3-carat diamond costs $30,000 or $40,000 and you can’t remember things like that, you stand to lose a lot of money very quickly,” Tedrow said.

After entering medical retirement, he and his wife downsized their lives and moved to Durham. They continued working to find a viable transplant candidate, a process that often proves unsuccessful due to lack of liver donors available for people needing transplants.

He said his liver completely shut down near the end of March 2014.

On April 3, 2014, what he called “within days of dying,” a liver was found that uniquely matched Tedrow’s body type.

The transplant operation carried high risk and led to other long-term health effects, but it saved his life.

Getting back into the workforce

A year after his transplant, Tedrow became eligible for Medicare. He said he didn’t fully understand the health insurance program, which is offered to Americans aged 65 or older or with certain disabilities and began to learn everything he could about it.

That led him to the Senior Health Insurance Information Program. It’s designed to advise Medicare-eligible patients on their best options for health care plans and receives state funding and sponsorship.

After going home and looking over their plan, Tedrow “re-read the entire Medicare manual” and came up with his own plan.

To get the day's news and headlines in your inbox each morning, sign up for our email newsletters.

“I called them up, went in and met with them, and they said, ‘You know what? That sounds like a good idea,’” Tedrow said. “Then they looked at me and said, ‘You know what? How would you like a job?’”

Tedrow became a voluntary Medicare counselor with the program for two years. He couldn’t work full-time, as he was going through vocational rehab and trying to get off disability.

“It just was right in front of my face to open up my own company,” Tedrow said. “That way I’m not going to have to worry about finding an employer that’s going to accept my limitation, my disabilities.”

With that, Senior Health Insurance Brokers was born.

Creating a successful health care brokerage his own way

The key to growing the company so quickly, Tedrow said, has been developing his personal understanding of the Medicare program.

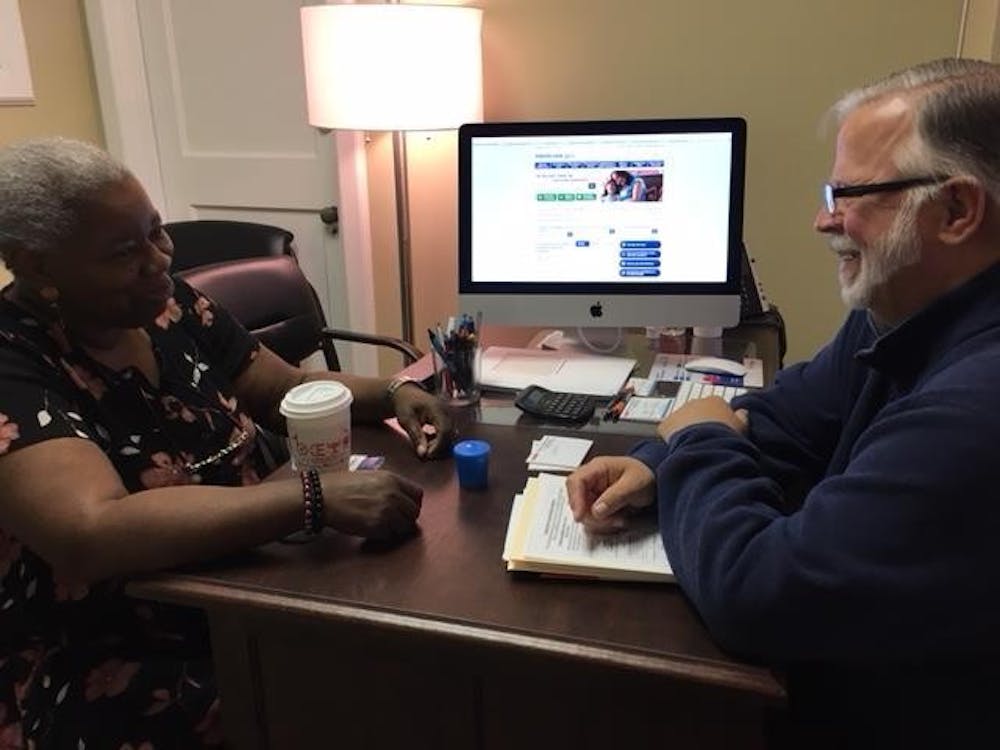

Tedrow called Senior Health a “niche company,” focusing its services on all Medicare products and products that effect Medicare-eligible patients. He calls it “one-stop shopping” for Medicare patients. He operates as the company’s only broker, with Mary running the office and the books.

He said Mary is working on acquiring her license and becoming a broker. Senior Health also plans to add one or two more brokers soon, as its client base expands.

Tedrow’s health remains a major roadblock. He will be immunosuppressed for the rest of his life following the transplant. That means his body is much more vulnerable to illnesses, and he faces severe risks around any large group of people.

Last year, Tedrow spent 30 days in the hospital, with some of those being dedicated to a surgery he needed. At this point in 2018, he’s spent 26 days in hospitalization due to an infection he contracted from that surgery.

Despite that, Tedrow is grateful to be in the workforce full-time again. Speaking to the long-term value of his company, Tedrow said its independence is how it will continue to grow.

“I’m not a captive agent,” Tedrow said. “I’m not working for a particular company. I’m not working for Blue Cross Blue Shield, I’m not working for Humana, I’m not working for Aetna. I’m working for you.”

university@dailytarheel.com

@CharlieMcGeeUNC