Last week, the infamous trading platform Robinhood closed all purchases made into undervalued companies, most notably GameStop, but included other shares into AMC Entertainment, Nokia and BlackBerry.

In a blog post released by Robinhood, the retail seller said, “In light of recent volatility, we restricted transactions for certain securities to position closing only.”

At that time, shareholders could either move their purchased stocks from Robinhood to other trading platforms, or they could sell the stocks out of fear of loss.

Alexander Arapoglou, a finance professor in the Kenan-Flagler Business School who teaches classes on hedge funds, trading and financial risk management, said that because Robinhood clears through Citadel, a multinational hedge fund company, its actions follow the margin requirements that the hedge fund mandates.

“As the price becomes more volatile, the possibility of loss becomes greater to the clearer, so consequently, Citadel will start asking for more margin,” Arapoglou said. "If Robinhood cannot supply them with that margin to protect for the loss, Robinhood then has to restrict the amount that's traded.”

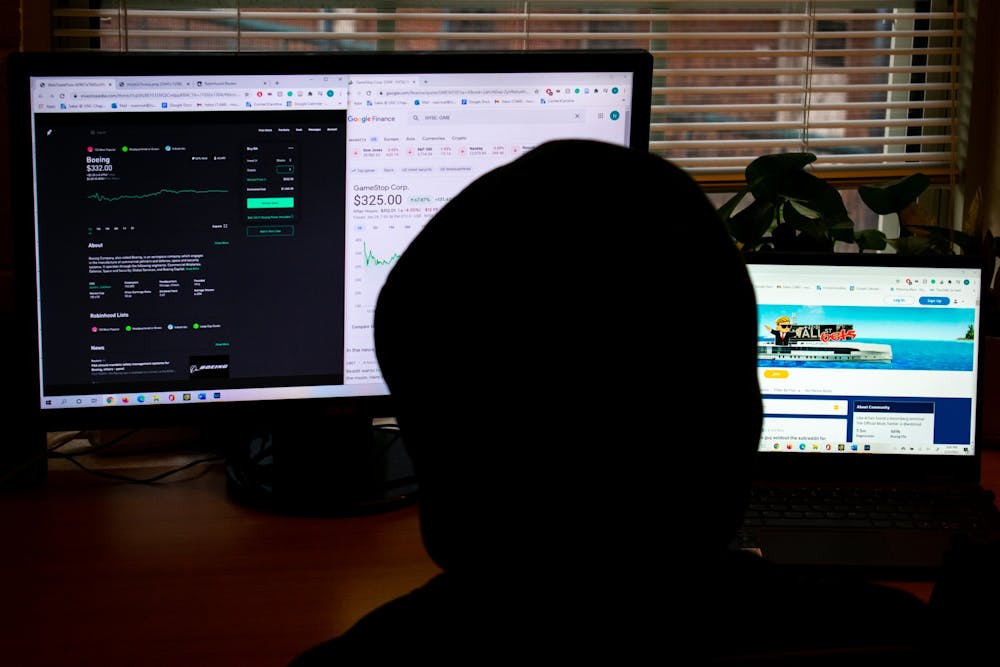

In December, the stock price for GameStop was a meager $4 — but the price skyrocketed to roughly $350 within the month of January alone. This expansion of interest into "dark horse" stocks came from social chat rooms on Reddit. Posts on the r/WallStreetBets subreddit informed investors of the inner workings of hedge funds’ playbooks and their billion-dollar bets against stocks they believed would plummet.

Millennials are one of the main demographics for retail stockbrokers like Robinhood, TD Ameritrade and Fidelity. The accessibility and ease that these platforms provide have sparked an interest among young people and have created new ways for them to make money — or even irritate wealthy pockets.

“I thought to myself that I had some extra disposable income that I could put away, and decided that I would be fine to lose the money if it meant hurting hedge funds,” Kayla Pope, a junior majoring in public policy and interdisciplinary studies, said. “I figured there aren't many instances where you can go against a system on a scale that actually hurts the top one percent, and that participating would be worth it.”

The insurgency to purchase stock in companies like GameStop and AMC could aggravate the fortunes of brokerage firms and individuals who make billions from the act of shorting stock — and those that participated in r/WallStreetBets understood that.