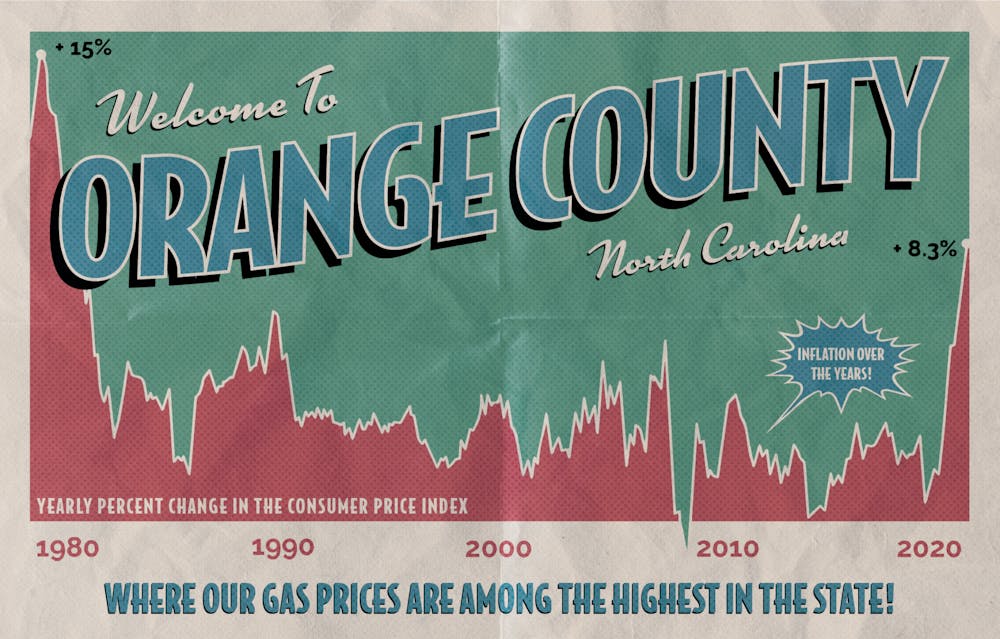

“The inflation that we've seen has been in gasoline prices and in food prices, and those are items that lower-income, disadvantaged households consume more of relative to other things,” Cohen said. “This is a case where inflation — I mean, it hurts everybody — but in particular it has been very painful for lower-income households.”

Orange County Economic Development director Steve Brantley also noted that the Triangle’s unique socio-economic circumstances have resulted in increased challenges for its most economically vulnerable residents.

“We have a higher cost of living in the Triangle compared to more rural North Carolina, and we also have a higher per capita income with a lot of wealth here,” he said. “But while higher-paid residents can more easily weather the current inflation, that is much less true for area residents who do not share the same social and economic cushion.”

Traditionally, inflation is managed by the Federal Reserve, which uses monetary policy to keep inflation stable at around two percent.

However, Cohen said that the lingering effects of the COVID-19 pandemic, global supply chain issues, the war in Ukraine and government fiscal stimuli in 2020 and 2021 have created a crisis that economists have struggled to overcome with traditional policy tools.

Impact of the Inflation Reduction Act

Some of the measures in the Inflation Reduction Act include tax credits for investment into renewable energy, modifying a tax credit for purchasing electric vehicles and other efforts to move away from fossil fuel energy sources.

“These are a set of policies that are generally good for the economy because they look to convert away from carbon-driven energy sources and limit the need for foreign oil,” Cohen said.

In Orange County, Deputy County Manager Travis Myren said the bill would fund efforts to purchase zero-emission vehicles, particularly large trucks and buses, as well as by providing money for renewable energy projects.

However, Cohen said it would take time for these changes to come into effect.

“All of these things are going to be good at reducing inflation or increasing the supply side, but they're not going to do it tomorrow, and they're not going to do it over the next six months,” Cohen said. “It's not a magic bullet for tomorrow.”

While local governments cannot do much to shape national economic or fiscal policy to fight inflation, Myren said Orange County has implemented programs meant to ease the consequences of higher prices — most notably by supporting residents struggling to pay for rent, utilities and food.

To get the day's news and headlines in your inbox each morning, sign up for our email newsletters.

Such policies include the Housing Choice Voucher Program, which assists low-income families looking for housing; the Emergency Housing Assistance fund, which helps Orange County residents escape eviction and homelessness; and the Low Income Energy Assistance Program, which provides a one-time payment for households unable to pay their heating bills.

Myren said residents can learn about these opportunities by visiting the county's website, going to the housing and social services departments and looking at the various eligibility criteria, program benefits and application instructions.

Additionally, Brantley said the Office of Economic Development has conducted programs to protect small businesses and jobs throughout the county, including providing over $1 million in grants to businesses struggling with inflationary challenges, as well as recruiting businesses in order to create stable, well-paying jobs.

“There are things you can do in the medium and long term,” Cohen said. “The best we can do at this juncture is to support people who are hurting the most.”

@harrisonggummel

@DTHCityState | city@dailytarheel.com