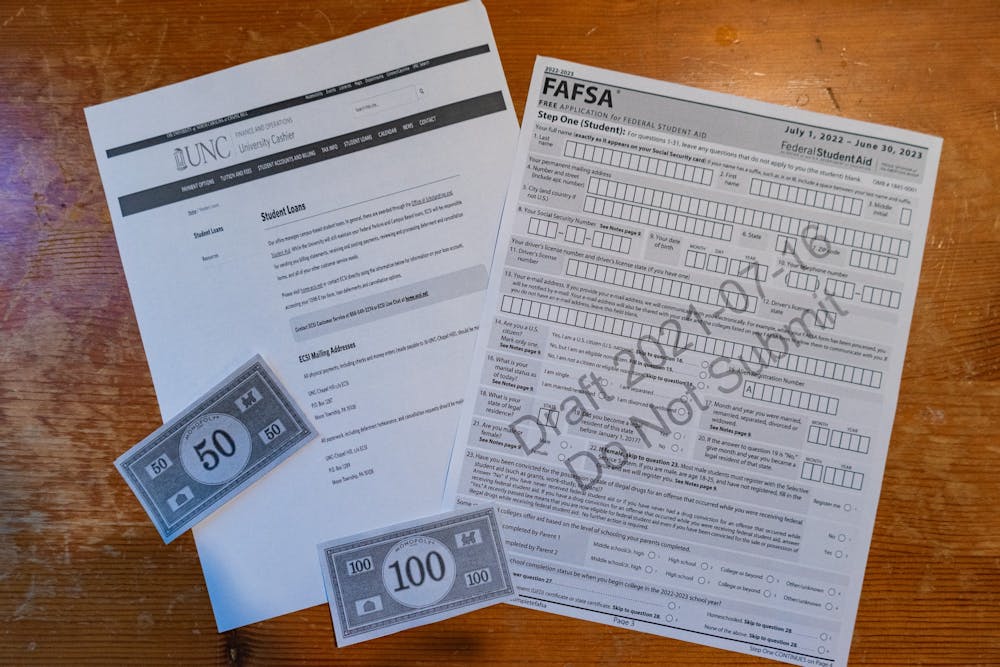

What is perceived as the "golden ticket" into a white-collar job will put the average person about $39,351 in debt.

This golden ticket – a college degree – leaves 60.5 percent of those who attend graduate school and 54.2 percent of undergraduate students with often tremendous amounts of federal loan debt, according to EducationData.org.

And most, around 53 percent, of those recent graduates are unemployed or underemployed, according to research from the University of Washington.

Constant discussion is being raised about the overbearing cost of higher education, the concerning amount of money people have borrowed and the people who have a degree but aren’t using it.

We, as students, run the risk of fitting into one or more of these categories.

While it's easy to simply suggest that our student loans be forgiven, it's more important to note that education is simply too expensive and inaccessible for most Americans. At the same time, a college degree is necessary to earn livable wages and have desirable career outcomes in today's economic climate.

This past week in particular has been of great importance to people who have taken out loans to pay for their education. Millions of borrowers have been waiting in the shadows to hear whether President Joe Biden will extend the pause on federal student loan payments that is set to expire at the end of this month. Student loan debt payments have been frozen since the beginning of the COVID-19 pandemic.

This Wednesday, Aug. 24, Biden announced he will extend the freeze on payback payments until the end of the year and that loan forgiveness will be granted to borrowers.

Borrowers who hold loans with the Department of Education and make less than $125,000 a year are eligible for $20,000 in loan forgiveness if they received Pell Grants, and $10,000 in loan forgiveness if they did not receive such grants.