Students’ eligibility for Pell Grants is determined by the information they submit in their Free Application for Federal Student Aid (FAFSA).

According to the UNC System, over one-fifth of undergraduate students received a Pell Grant in 2021.

Forgiveness at UNC

Assistant UNC Law Professor Kate Sablosky Elengold said even students who are not Pell Grant recipients can qualify for a large amount of their debt to be forgiven.

Students whose income falls under $125,000 if they are single tax filers — or $250,000 for married couples — qualify for up to $10,000 of their loans to be forgiven.

However, Sablosky Elengold said the forgiveness only applies to loans from the Department of Education and those taken out before July 1, 2022.

This includes Parent PLUS and other federal loans disbursed by the federal government. It does not include any loans taken out from banks or other lenders, Sablosky Elengold said.

And this $10,000 of debt forgiveness hinges on another factor that is unique to current students — whether or not they are dependent on their parents.

If a student is claimed as a dependent on their parent’s taxes, the income stipulations shift to their parents. If a student’s parent(s) make more than the income threshold, then students are not eligible for the aid, regardless of whose name is attached to the loan, Sablosky Elengold said.

“It’s something that happens for taxes,” she said. “If the parent is taking a deduction for a child as a dependent, then it’s the parent’s income that matters.”

Rachelle Feldman is the vice provost for enrollment at the University. She said that UNC is one of few institutions that uses need-blind admissions and meets 100 percent of undergraduate’s documented financial need — as long as they apply on time.

“This means for students from North Carolina and across the United States, we meet the full demonstrated financial need of all undergraduate students with a combination of grants, scholarships, work-study and student loans," she said in an email statement.

To get the day's news and headlines in your inbox each morning, sign up for our email newsletters.

But for some undergraduate students, demonstrated financial need falls short of reality.

Forgiveness for students

Leah Whitfield is an out-of-state sophomore from Tennessee. She said her family is just above the criteria of demonstrated need.

“I can’t get aid,” Whitfield said. “We’re just above the point where I can’t get any aid at all. I’ve looked into scholarships, but all the scholarships — at least at UNC that I'm seeing — are for 'juniors in this specific thing' or 'seniors in this specific thing.' A lot of the things, too, are for in-state students."

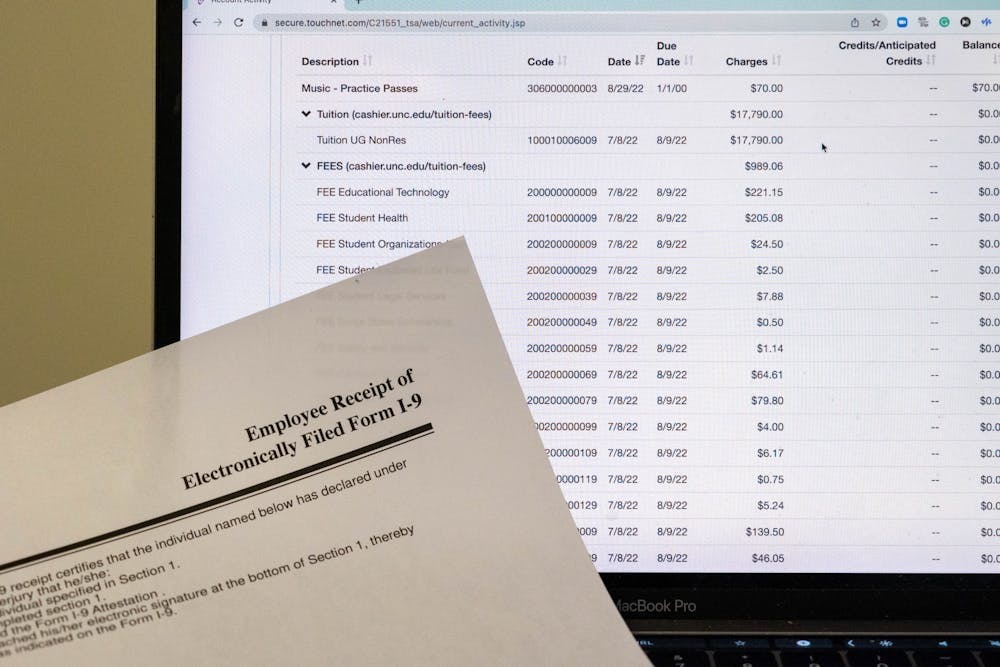

She said that just tuition alone for her four years at UNC will require almost an entire year of her father’s pay.

“Everything that he’s done, I feel like is just going down the drain to pay for my schooling,” she said. “I might not even be able to make enough to pay for my children’s schooling if this inflation thing keeps going. The only people that are going to be able to go to college will be children of billionaires and millionaires and that’s ridiculous.”

30 years ago, tuition for in-state UNC students was $822. Today, it is over eight times as much, with 2022-2023 in-state students paying $7,020 in tuition, according to UNC Scholarships and Student Aid.

Tuition costs are even more expensive for out-of-state students. Today, they pay $35,580 — over five times as much as in-state students. This amount is also almost five times as much as 30 years ago.

“We all know that wages don’t really increase with inflation,” Whitfield said. “So while some people might’ve been able to pay off their school debt in the past fairly fast, we’re not getting paid enough to pay it off proportionally as much as they would be able to. So, it’s just really not possible, all around.”

Forgiveness in the future

Sablosky Elengold said she encourages all students to start preparing for the loan forgiveness application now, whether that means learning if they are dependents and gathering their parent’s tax information, or just simply signing up on the Department of Education’s subscription page to be notified of the application going live.

According to the Department of Education, even students who paid off their federal loans previously are eligible for a refund, as long as these payments were made during the payment pause, which started on March 13, 2020.

The application’s opening date will be announced in the near future and individuals will have until Dec. 31, 2023 to apply.

The N.C. Department of Revenue recently announced that student loan forgiveness will be considered taxable income.

“I would encourage everyone to put in an application, even if they think it should be automatically forgiven,” Sablosky Elengold said. “It’s a lot of paperwork, it’s a lot happening all at once at the Department of Education, and I would encourage people to be their own best advocates.”

@batkinson2501

university@dailytarheel.com