At the beginning of March, the UNC Management Company released the UNC Investment Fund and Chapel Hill Investment Fund 2023 annual reports, which reveal a decrease in investments in energy and natural resources from 4.8 percent to 4.6 percent from the fiscal year before.

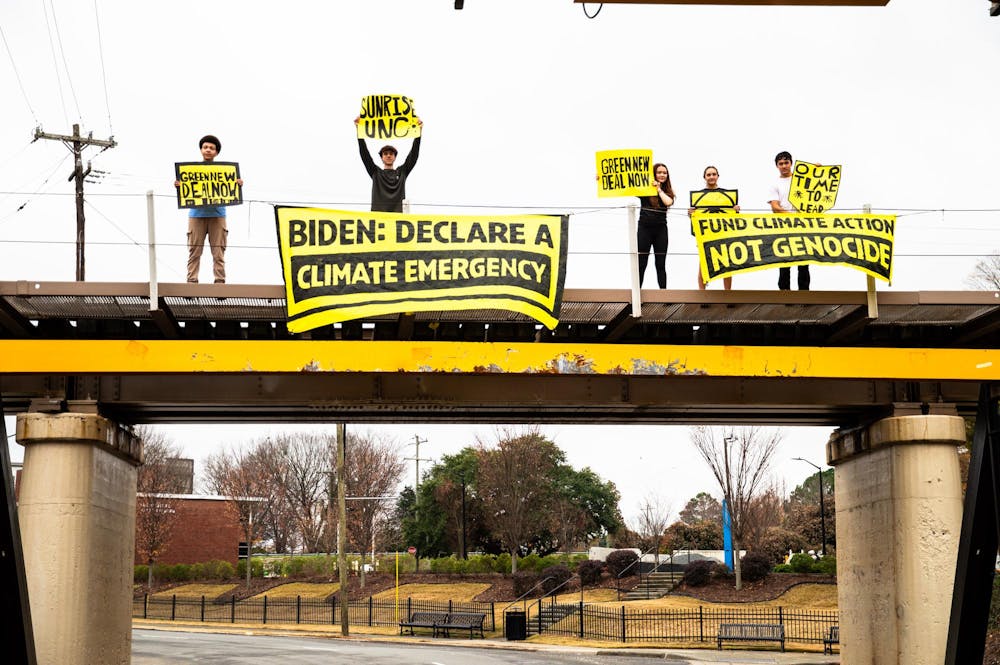

On Feb. 8, Sunrise UNC, the UNC chapter of the national youth-led Sunrise Movement launched to address climate change, released a report estimating that the University owns at least $243 million in fossil fuel commodities — excluding stocks, bonds and debt — through the UNCIF.

The fund is a portfolio of asset allocations among the UNC System’s 32 members,and Sunrise’s report is based on the fund’s annual reports from fiscal years 2010 to 2022.

The UNC Management Company, the nonprofit organization that determines asset allocations of the UNCIF, is overseen by the CHIF's Board of Directors. The CHIF is the controlling member of the UNCIF.

According to UNCIF’s Annual Report for the 2022 fiscal year, the management company was working with a total of $10.433 billion to allocate across all seven asset classes, including energy and natural resources.

Roughly $5.245 billion of this went to the CHIF, 4.8 percent of which was invested in energy and natural resources, which includes oil, natural gas, power and other commodity-related investments.

CHIF’s FY2020 report stated that the UNCIF owned $9.8 million in sustainable, clean energy-focused investments by the end of the year, constituting 3.26 percent of the fund’s total energy investments. Sunrise’s report stated that if this percentage remained consistent between 2020 and 2022, UNCIF and CHIF’s investments in fossil fuel commodities would likely have reached at least $243 million in 2022.

In September 2014, the UNC Board of Trustees passed a resolution requesting that the management company research specific investments to advance environmentally friendly clean energy strategies.

Sallie Shuping-Russel, a former BOT member from 2007 to 2015 and UNCIF board member from 1995 to 2020, said the resolution was part of a package of efforts to make the University more environmentally sensitive.