In July, U.S. Centers for Medicare and Medicaid Services approved a medical debt relief incentive program for acute care hospitals in North Carolina proposed by Gov. Roy Cooper and the N.C. Department of Health and Human Services.

The program intends to forgive all medical debt for patients enrolled in N.C. Medicaid beginning from 2014 and grant discounts on medical bills for patients with incomes at or below 300 percent of the federal poverty level.

Acute care hospitals — which provide emergency services for patients with urgent medical conditions — are the only type of hospitals eligible for this program. They are one of the primary care providers for rural areas with concentrated low-income populations, where medical debt tends to be more prevalent.

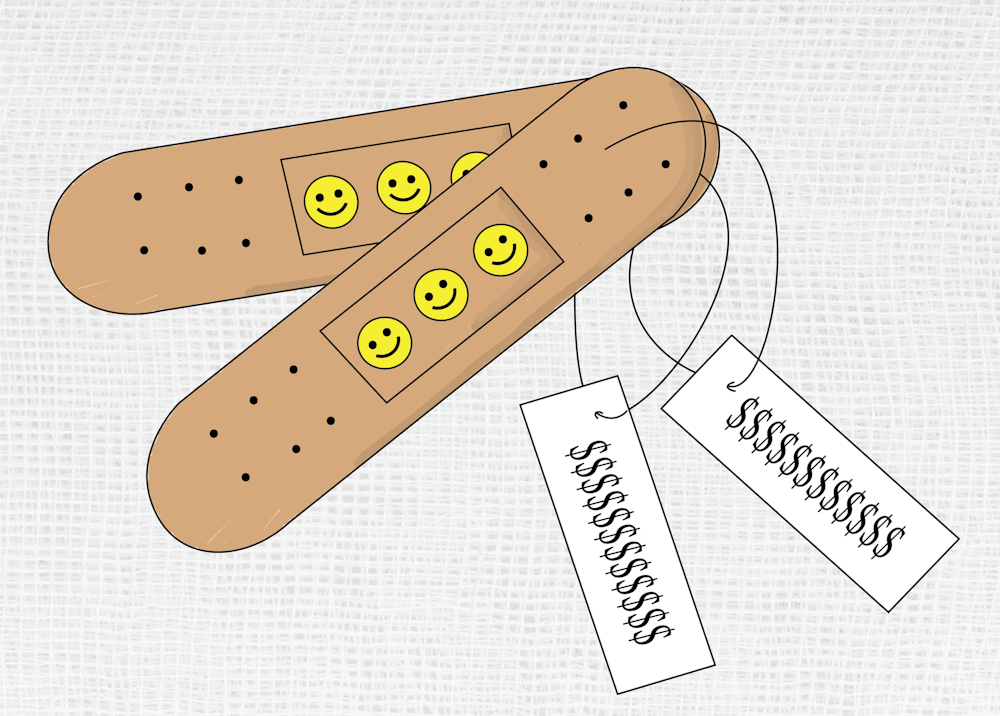

Medical debt in North Carolina

North Carolina has the 4th highest percentage of people with medical debt in the country. According to 2022 data from the Urban Institute, 20 percent of North Carolina residents have medical debt — equating to more than 2 million individuals.

In some counties, including Anson County and Greene County, over 40 percent of residents have medical debt.

According to a study conducted by Duke University School of Law, state hospitals sued over 7,500 patients between January 2017 and June 2022 to collect medical debt through interest charges. The hospitals won over $57 million.

“People have a higher fear of the medical bill today than they do the medical procedure,” N.C. State Treasurer Dale Folwell said. “Nobody consumes healthcare in the state, it consumes them.”

In May 2023, the N.C. Senate unanimously passed Senate Bill 321 — the Medical Debt De-Weaponization Act. The bill served as a consumer protection statute to prevent healthcare creditors from using unfair methods of medical debt collection. After passing through the Senate, the bill was referred to the N.C. House and has not since moved.