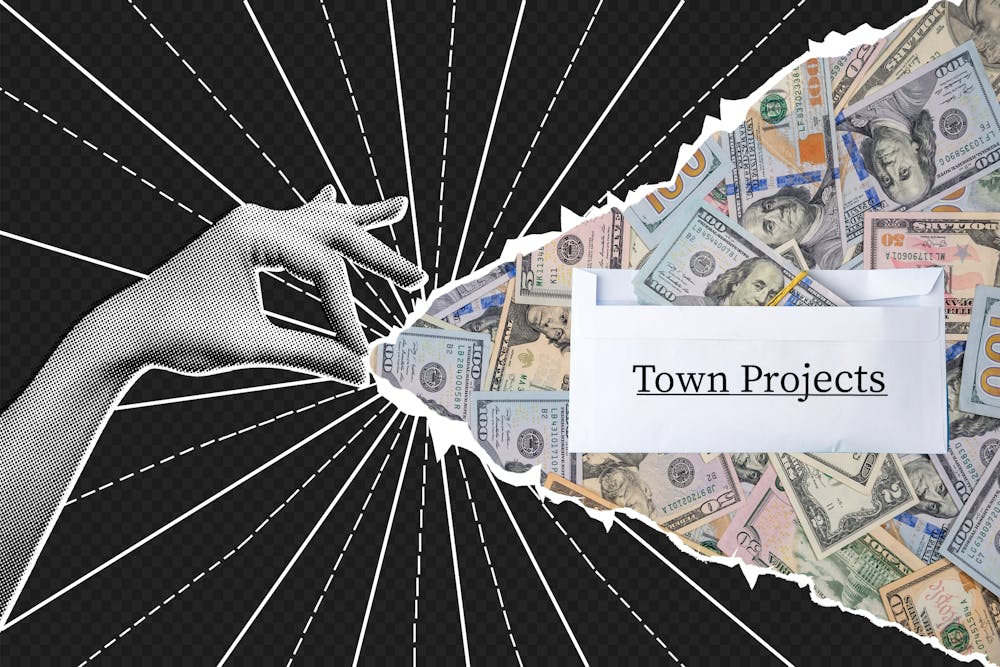

In the November election, Chapel Hill voters approved five bond referendums allowing the Town of Chapel Hill to borrow up to $44 million. The Town plans to invest the money into local infrastructure projects.

Peter Norman, UNC economics professor, said general obligation bonds are essentially loans that are borrowed by a municipal government that are typically paid back through tax revenue.

Since 2009, the Town has been setting aside a fraction of existing property tax payments to develop a fund to help pay back debt and interest payments, Town of Chapel Hill Business Management Director Amy Oland said. Oland said the fund will assist in paying back the bonds.

The debt fund serves as a funding mechanism that allows the Town to borrow money in the future, Oland said. Oland said this means the Town will not need to increase property taxes in order to pay back the money borrowed through the bonds.

“The nice thing about that [debt fund] is that we’ve built this into our model, it’s a long-term forecasting model, and so we’ve built up this ability to issue these bonds over this period of time and we will have the capacity to make those payments," Oland said. "There won’t be any negative financial impacts because we’ve already built that into our plans."

Chapel Hill Town Council Member Melissa McCullough said the Town has a very high bond rating, meaning it can borrow more money with a lower interest rate. She said the Town’s issuance of the bonds will not impact Chapel Hill’s financial health and credibility, as long as the money is paid back on time.

Oland said the bonds are the most cost-effective method for the Town to borrow money because they have low interest rates and are risk-averse.

However, the approval of the referendums only grants the Town the authority to issue the bonds and does not necessarily grant the Town the money, Oland said. To have the money deposited into the Town’s accounts, they must undergo a rigorous and prescribed process through the state, she said.

Oland said Town staff will have to go to the Town Council three times for approval and fill out a lengthy application that must be approved by the Local Government Commission (LGC), which operates under the state treasurer's office.